IRR stands for Internal Rate of Return. It’s a financial metric used to evaluate the profitability of an investment.

In simple terms:

IRR is the discount rate that makes the Net Present Value (NPV) of all future cash flows (both incoming and outgoing) from an investment equal to zero.

Why it’s useful:

- It helps compare the attractiveness of different investments.

- A higher IRR generally means a more profitable or desirable investment (assuming similar risk levels).

Formula (not usually calculated by hand):

There’s no explicit formula for IRR like there is for ROI. It’s found iteratively (e.g., using Excel or financial calculators): 0=∑t=0nCt(1+IRR)t0 = \sum_{t=0}^{n} \frac{C_t}{(1 + IRR)^t}

Where:

- CtC_t = net cash flow at time tt

- nn = total number of time periods

- IRRIRR = the internal rate of return

In Excel:

You can use:

=IRR(range_of_cash_flows)

Example:

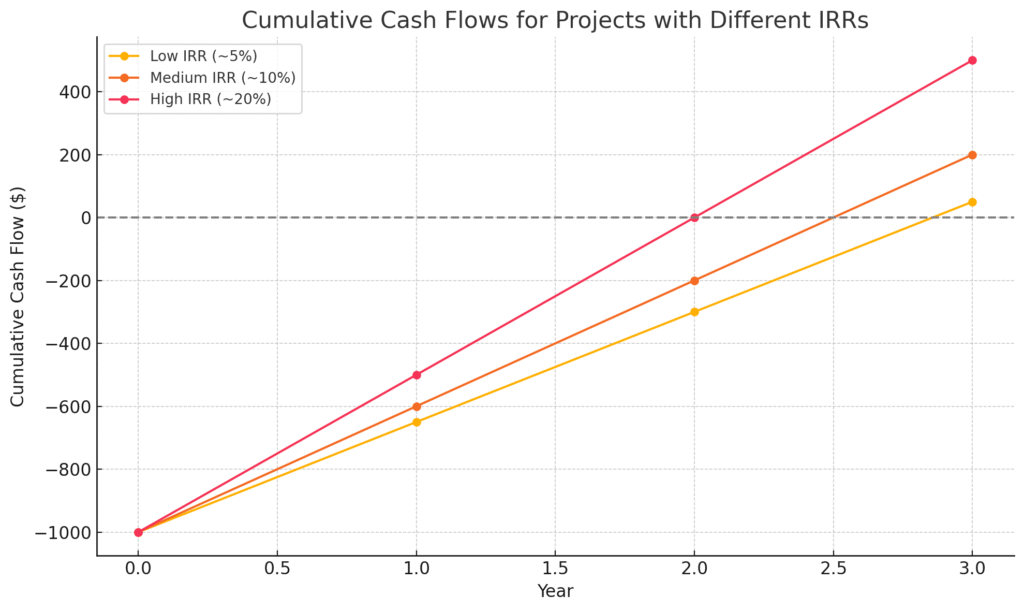

You invest $1,000 today and expect to receive $400 per year for 3 years.

Cash flows: -1000, +400, +400, +400

IRR ≈ 9.4%