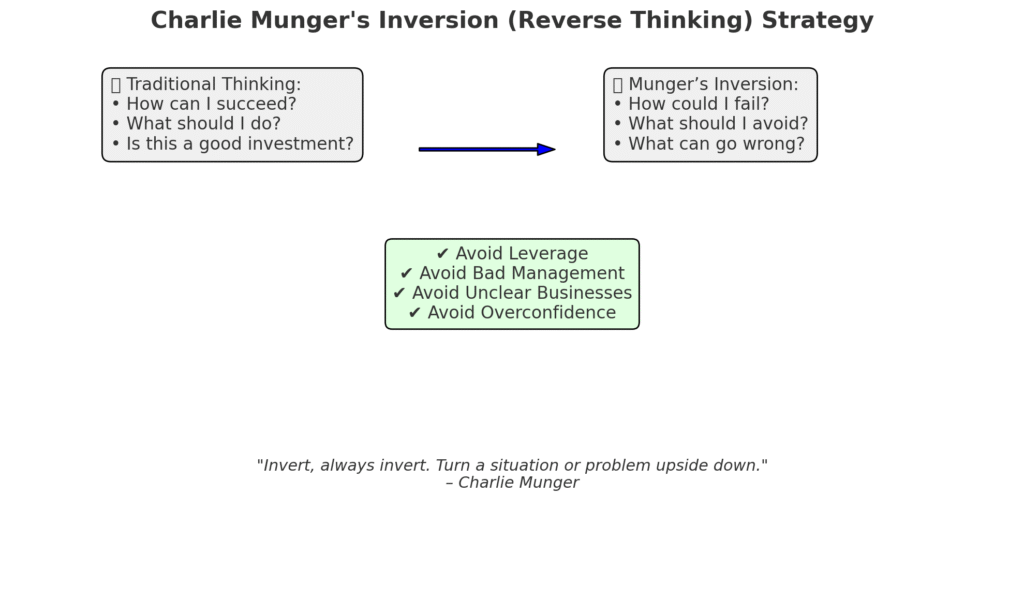

Charlie Munger famously used reverse thinking, often called inversion, as a core mental strategy.

🔄 What Is Reverse Thinking (Inversion)?

Instead of asking: “How can I succeed?”,

Ask: “What would cause me to fail?”

— then avoid those things.

🧠 Munger’s Reverse Strategy in Action:

1. Avoiding Stupidity > Chasing Genius

- Munger believed it’s easier to avoid being stupid than to try to be brilliant all the time.

- Quote: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid.”

2. Inverting Investment Decisions

- Instead of asking: “Is this company a great buy?”

He would also ask:

“Under what conditions would this investment go wrong?” - He’d look for:

- Overhyped growth

- Poor management

- Debt risk

- Declining industry

- Conflicts of interest

3. Life Strategy Inversion

- Munger often asked: “What would a miserable life look like?”

Then avoided those behaviors:- Addictions

- Toxic people

- Arrogance

- Laziness

🧩 Example in Investing:

Instead of only asking:

- ✅ “What makes a great business?”

He would ask:

- ❌ “What kills businesses?”

Answer:

- Too much debt

- Loss of pricing power

- Bad capital allocation

- Disruption by new tech

Avoiding these risks becomes the investment strategy.

🧭 Summary of Reverse Strategy (Inversion Thinking)

| Traditional Question | Munger’s Inverted Question | Benefit |

|---|---|---|

| How can I succeed? | How can I fail? | Avoids preventable disasters |

| What should I do? | What should I avoid doing? | Clears out bad options first |

| Is this a good stock? | What would ruin this investment? | Detects hidden risk early |

Final Quote:

“Invert, always invert. Turn a situation or problem upside down. Look at it backward.”

— Charlie Munger